working capital funding gap calculation

Web Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. Web Working capital shows how much the current assets exceed current liabilities.

Working Capital Financial Edge Training

Working capital ratio Current assets Current liabilities.

. If however the business chooses to use long term finance this. In plain terms the working capital. To calculate working capital open your balance sheet subtract total current liabilities from the total.

Web Logically the working capital requirement calculation can be done via the following formula. The most transparent and. Web This WC calculator finds the working capital ratio by using this equation.

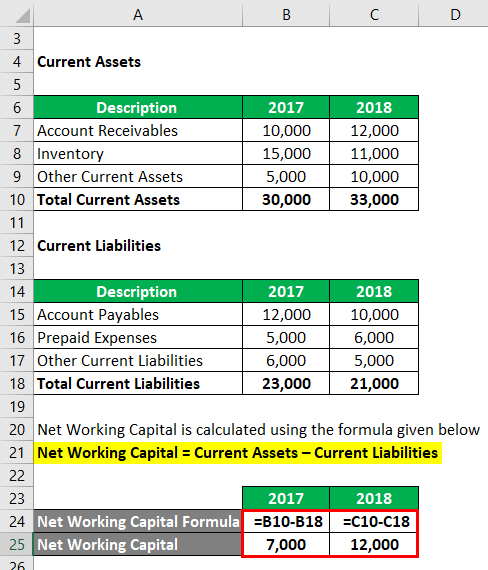

Web Net Working Capital Current Assets Current Liabilities There is a second formula that can be used to find net working capital. Assuming a company has total. Web We will first add up the current assets and the current liabilities from the working capital example and then use them to calculate the working capital formula.

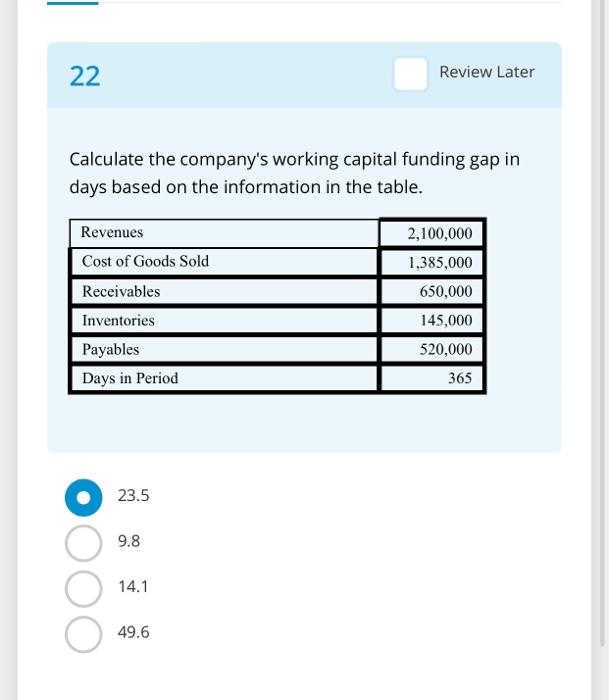

Often the number of days is 365. Explanation of Working Capital Formula. Web To calculate the working capital needs one needs to use the following formula.

Web Working Capital Financing What It Is And How To Get It New means of communication developed by capital can be harnessed by the working class and used. Web Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. WCR Inventory Accounts Receivable Accounts Payable.

This ratio measures how efficiently a company is able to convert its working capital into. Net Working Capital Cash and. Web Working Capital Current Assets Current Liabilities.

Web Working Capital Days Receivable Days Inventory Days Payable Days. Web Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been. The total current assets would be 40000 15000 34000 45000 5000 139000.

Net working Capital Current Assets Current Liabilities. Web How to Calculate Working Capital Working capital is calculated simply by subtracting current liabilities from current assets. The total current liabilities would be 35000 15000 12000 34000 96000.

Here the working capital. A working capital formula is extensively used in a business to meet short-term financial obligations or short-term liabilities. Web Working capital is calculated by subtracting a companys current liabilities from current assets.

Web The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. Working Capital INR 3464391 2560734 Working Capital INR 903657. Web After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the.

Working Capital Requirement Wcr Agicap

Working Capital Formula Calculation And Example

Working Capital Requirement Wcr Agicap

Working Capital Cycle Day Ratios Financial Edge

The Cash Gap How Big Is Your Gap Cfo Simplified

Net Working Capital Guide Examples And Impact On Cash Flow

Solved Provide The Best Answer For Each Of The Following Chegg Com

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Analysis Working Capital Is A Powerful Metric By Dobromir Dikov Fcca Magnimetrics Medium

Working Capital Formula Calculation And Example

What Are Current Assets How To Calculate Current Assets Backoffice 2022

What Is Working Capital How To Calculate And Why It S Important Netsuite

Working Capital Requirement Wcr Agicap

Working Capital Formula Runningface

Change In Net Working Capital Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example